# Can I Transfer Money from Trust Wallet to Bank Account?

In recent years, the adoption of cryptocurrency has surged, leading to a wide array of digital wallets designed to facilitate the buying, selling, and storage of cryptocurrencies. One such wallet is Trust Wallet, which has gained popularity due to its user-friendly interface and compatibility with a variety of cryptocurrencies. However, many users often find themselves asking, “Can I transfer money from Trust Wallet to my bank account?” This article aims to provide a comprehensive look at the possibilities, processes, and considerations involved in transferring funds from Trust Wallet to a bank account.

## Understanding Trust Wallet

### What is Trust Wallet?

Trust Wallet is a decentralized multi-currency wallet that enables users to store, manage, and trade a wide range of cryptocurrencies. Launched in 2017 and later acquired by Binance, Trust Wallet ensures that users retain control over their private keys, making it a popular choice among crypto enthusiasts. The wallet supports thousands of cryptocurrencies and tokens, including Ethereum (ETH), Bitcoin (BTC), and various ERC-20 and BEP-2 tokens.

### Features of Trust Wallet

1. **Decentralization**: Trust Wallet is non-custodial, meaning users have complete control over their private keys. This adds a layer of security as users are not dependent on a third-party provider to safeguard their assets.

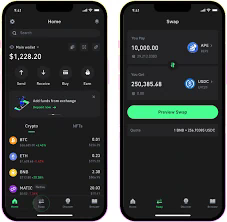

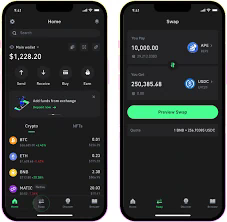

2. **User-Friendly Interface**: Designed with user experience in mind, Trust Wallet offers an intuitive interface that caters to both beginners and experienced users.

3. **DApp Browser**: The wallet includes a decentralized application, or DApp, browser, allowing users to interact with decentralized exchanges (DEX) and other blockchain services directly from the wallet.

4. **Multi-Currency Support**: With support for numerous cryptocurrencies, Trust Wallet allows users to manage various assets under one roof without needing multiple wallets.

## The Process of Transferring Funds

### Converting Cryptocurrencies to Fiat

Before transferring money from Trust Wallet to a bank account, users must first convert their cryptocurrencies into fiat currency (e.g., USD, EUR). This typically involves using a cryptocurrency exchange or a brokerage service. Below are the steps to facilitate this conversion.

1. **Select a Cryptocurrency Exchange**: Choose a cryptocurrency exchange that supports both your desired cryptocurrency and fiat withdrawal to your bank account. Popular exchanges include Binance, Coinbase, Kraken, and Bitstamp.

2. **Create an Account**: If you do not already have an account with the selected exchange, you’ll need to register and complete any necessary verification processes.

3. **Transfer Funds to the Exchange**: Go to Trust Wallet and initiate a transfer of the cryptocurrency you want to convert. Copy the deposit address provided by the exchange and paste it into Trust Wallet when prompted. Ensure you are sending the correct type of cryptocurrency to avoid loss of funds.

4. **Sell the Cryptocurrency**: Once the transfer is successful and the cryptocurrency is available in your exchange account, you can place a sell order for your cryptocurrency to convert it into fiat.

5. **Withdraw Fiat to Your Bank Account**: After converting your cryptocurrency into fiat currency, navigate to the withdrawal section of the exchange. You will need to enter your bank account details and specify how much money you wish to withdraw. Follow the exchange’s instructions to complete the withdrawal process.

### Direct Transfers to Bank Accounts

While the steps above outline the general process, some users may wonder if there’s a more direct way to transfer funds from Trust Wallet to a bank account without using an exchange. Currently, Trust Wallet does not allow direct fiat withdrawals. Thus, the use of an intermediary platform is necessary for cashing out funds.

## Choosing the Right Exchange

### Factors to Consider

When choosing a cryptocurrency exchange for converting and transferring funds, several factors must be taken into consideration:

1. **Regulatory Compliance**: Ensure that the exchange operates in compliance with local regulations and possesses the necessary licenses to facilitate fiat transactions.

2. **Fees**: Examine the fee structure for both trading and withdrawals. Some exchanges may have higher fees for fiat withdrawals or might impose withdrawal limits.

3. **Supported Methods of Withdrawal**: Look into how the exchange allows users to withdraw their funds. Common methods include bank transfers, wire transfers, and even direct debit to credit cards.

4. **Reputation and Trustworthiness**: Research the exchange’s reputation by reading user reviews and checking for any security breaches or major incidents in the past.

5. **User Experience**: A user-friendly interface can significantly improve the process, especially for beginners. Look for platforms that are easy to navigate and provide robust customer support if needed.

### Popular Exchanges for Fiat Withdrawals

Here are several popular exchanges that allow users to convert cryptocurrencies to fiat and withdraw to bank accounts:

– **Binance**: One of the largest exchanges worldwide, Binance supports numerous fiat currencies for withdrawals and offers a straightforward user interface.

– **Coinbase**: Known for its ease of use, Coinbase is an excellent option for beginners looking to cash out quickly, as it supports a variety of payment methods for bank withdrawals.

– **Kraken**: Kraken provides advanced trading features and supports a wide range of fiat withdrawals, making it a viable option for users in multiple countries.

## Risks and Challenges

### Security Risks

1. **Exchange Vulnerabilities**: Utilizing exchanges introduces risks, including hacking incidents that have historically led to significant losses for users. To mitigate this risk, consider transferring funds to exchanges with a strong security reputation and two-factor authentication.

2. **Phishing Scams**: Be wary of phishing attempts, where malicious actors lure users into providing private information through fraudulent communication. Always ensure you are accessing legitimate websites.

### Regulatory Challenges

1. **Legislation Variations**: The regulatory environment surrounding cryptocurrencies varies significantly by jurisdiction. Certain regions may have specific laws regarding the use and transfer of digital currencies, which could impact the viability of transferring funds to a bank account.

2. **KYC Procedures**: Many exchanges require users to undergo Know Your Customer (KYC) verification processes, which may include submitting identification documents. Users sensitive to privacy may find this to be an obstacle.

### Market Volatility

Cryptocurrency markets are notoriously volatile. This unpredictability means that the value of your cryptocurrency may fluctuate between the time of conversion and the time of withdrawal. It’s essential to consider market conditions and, if necessary, set limit orders to strike a favorable deal.

## Conclusion

In summary, while it is not currently possible to directly transfer money from Trust Wallet to a bank account, users can convert their cryptocurrencies to fiat through exchanges which then allow bank withdrawals. This process, while straightforward, involves several steps and considerations, from selecting the right exchange to being mindful of security risks and regulatory compliance. With the continuous evolution of the crypto landscape, it is vital to stay informed of any changes in the process or emerging technologies that could simplify transactions in the future. By understanding these mechanisms, Trust Wallet users can safely navigate their way through cashing out their digital assets into their bank accounts.