# Does Trust Wallet Have a Debit Card?

## Introduction

In recent years, cryptocurrencies have gained immense popularity, creating a demand for user-friendly wallets and services that facilitate easy access and management of digital assets. Among the various cryptocurrency wallets available, Trust Wallet has emerged as a leading choice for many users due to its robust features, user-friendly interface, and integration with decentralized finance (DeFi). A common inquiry among Trust Wallet users is whether the platform offers a debit card, enabling them to spend their crypto assets in everyday transactions. This article delves into the topic, exploring Trust Wallet’s capabilities, its relationship with debit cards, and the broader context of using cryptocurrencies in daily life.

## Understanding Trust Wallet

### A Brief Overview

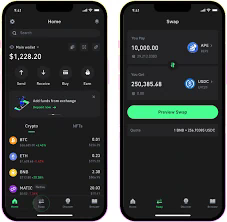

Trust Wallet is a decentralized, multi-currency mobile wallet that allows users to store, manage, and interact with various cryptocurrencies securely. Acquired by Binance in 2018, Trust Wallet supports a multitude of tokens across different blockchains, making it a versatile option for crypto enthusiasts. The wallet prioritizes user privacy and security, meaning users retain full control over their private keys.

### Key Features of Trust Wallet

– **Multi-Currency Support:** Users can manage a variety of cryptocurrencies, from Bitcoin (BTC) to Ethereum (ETH) and thousands of ERC-20 and BEP-20 tokens.

– **Private & Secure:** Trust Wallet ensures that only the user has access to their private keys, with no central authority able to control or access user funds.

– **Decentralized Access:** The wallet supports decentralized applications (dApps), allowing users to interact with DeFi protocols directly from their mobile devices.

– **User-Friendly Interface:** Designed for ease of use, Trust Wallet has an intuitive interface that caters to both beginners and experienced users.

## The Concept of Cryptocurrency Debit Cards

### What are Cryptocurrency Debit Cards?

Cryptocurrency debit cards are cards that allow users to spend their cryptocurrency directly by converting it to fiat currency at the point of sale. Essentially, these cards bridge the gap between traditional financial systems and the cryptocurrency ecosystem, enabling users to use their digital assets in everyday transactions. Users can load their crypto onto the card, which is then converted to local currency when making purchases.

### How Do Cryptocurrency Debit Cards Work?

When a user wishes to spend cryptocurrency using a debit card, the following process generally occurs:

1. **Load Funds:** The user transfers their crypto assets into the debit card’s associated account.

2. **Conversion:** The crypto is converted into fiat currency at the time of transaction, often using a real-time exchange rate.

3. **Purchase:** The user can then use the card for purchases at any merchant that accepts debit cards.

## Trust Wallet’s Position on Debit Cards

### Direct Debit Card Offerings

As of the latest information, Trust Wallet does not directly offer a proprietary debit card. However, this does not mean that users of Trust Wallet are entirely without options for spending their cryptocurrencies. Several third-party services allow integration with Trust Wallet to provide debit card functionalities.

### Third-Party Solutions

Several platforms provide debit card solutions that can be linked to Trust Wallet or allow users to transfer funds from their Trust Wallet accounts. Examples of services include:

– **Binance Card:** As part of its offerings, Binance provides a prepaid card that allows users to spend their crypto holdings. Users can transfer funds to their Binance account from Trust Wallet and then use the Binance Card for transactions.

– **Crypto.com Visa Card:** Users can transfer their assets to the Crypto.com platform and then obtain a Visa card that operates on the existing payment network.

– **Wirex and BitPay Cards:** These services allow users to convert cryptocurrency to fiat seamlessly, providing debit card access as well.

Each of these services typically requires users to complete a verification process, and they may charge fees for transactions or conversion.

## The Benefits of Using Crypto Debit Cards

### Increased Accessibility

Cryptocurrency debit cards enhance the accessibility of using digital assets for everyday transactions. They provide a familiar payment method, making it easier for users to spend their crypto holdings without needing to exchange them into fiat currency manually.

### Flexibility and Convenience

Having a debit card that is linked to a cryptocurrency wallet allows users to spend their assets on a broad array of products and services. This convenience means that crypto investors can use their assets in real-world scenarios, promoting the use of digital currencies.

### Rewards and Incentives

Many crypto debit cards offer rewards programs, cashback, and incentives for using the card. Users may benefit from earning cryptocurrency back on certain purchases, enhancing their overall investment.

## The Challenges of Cryptocurrency Debit Cards

### Regulatory Issues

Cryptocurrency regulations vary significantly by region, and this can pose challenges for debit card providers. Some countries have strict regulations surrounding the use of crypto, which can impact card availability and usability.

### Volatility

The inherent volatility of cryptocurrencies can be an issue for users of debit cards. Since the value of cryptocurrencies can fluctuate rapidly, the value of assets spent can drastically change, leading to potential losses for users who do not manage their crypto holdings prudently.

### Fees

Many cryptocurrency debit cards come with associated fees, which can include transaction fees, conversion fees, and monthly maintenance fees. Users should be aware of these costs, as they can diminish the benefits of using a crypto debit card.

## The Future of Trust Wallet and Cryptocurrency Cards

### Potential Developments

As the cryptocurrency landscape continues to evolve, there is the possibility that Trust Wallet may consider offering its own debit card in the future. Integration with existing payment systems could enhance user experience and expand the wallet’s capabilities.

### Strategic Partnerships

To cater to the needs of its user base, Trust Wallet could form partnerships with established debit card providers. This approach would allow Trust Wallet users to enjoy seamless spending options without compromising on security or privacy.

### Integration with DeFi and NFTs

The growing popularity of DeFi and non-fungible tokens (NFTs) could also influence how Trust Wallet positions itself in the market. By integrating advanced functionalities that allow spending and utilizing crypto assets in decentralized marketplaces, Trust Wallet could attract a wider audience.

## Conclusion

While Trust Wallet does not currently offer its own debit card, multiple third-party solutions make it possible for users to spend their cryptocurrencies conveniently. As Trust Wallet continues to grow in popularity, the demand for integrated payment solutions may lead to the introduction of new features or partnerships in the future. For now, cryptocurrency debit cards represent a viable means for users to access their digital assets in everyday situations, overcoming the barriers posed by traditional finance systems. As the crypto space evolves, the interplay between wallets, debit cards, and financial technologies will undoubtedly continue to reshape how consumers engage with digital currencies.