# Understanding Trust in Crypto and Bitcoin Wallets

As cryptocurrencies have become increasingly mainstream and widely accepted, the need for secure and reliable Bitcoin wallets has also grown significantly. Wallets serve as the bridge between users and the blockchain, providing the functionality necessary to send, receive, and store crypto securely. This article delves deep into the concept of trust in crypto wallets, particularly focusing on Bitcoin—arguably the most popular cryptocurrency. We will explore the various types of wallets, their security features, key management, and the challenges users face in placing trust in these digital tools.

## The Evolution of Bitcoin and Wallets

Bitcoin was introduced in 2009 by an anonymous person or group known as Satoshi Nakamoto. Originally intended as a decentralized alternative to traditional currency, Bitcoin paved the way for the evolution of blockchain technology. As its popularity surged, so did the need for a secure means to store and manage Bitcoin holdings. The first Bitcoin wallets primarily existed as software programs that stored private keys locally on a user’s device. However, with advancements in technology and increasing security threats, wallet types have significantly evolved.

Wallets are now categorized into two primary types: custodial and non-custodial. Custodial wallets are managed by third-party services, while non-custodial wallets allow users to retain full control over their cryptographic keys. This stark difference inherently influences the level of trust a user must exercise when choosing a wallet.

## Types of Bitcoin Wallets

### Custodial Wallets

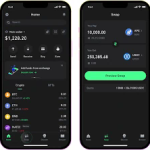

Custodial wallets are often offered by exchanges and platforms like Coinbase or Binance. They manage your private keys and facilitate transactions on your behalf. This arrangement can be convenient, especially for beginners unfamiliar with blockchain technology. However, trusting a third party with your keys means you rely on their security protocols and policies.

**Benefits and Drawbacks:**

– **Benefits:** Easier access, user-friendly experience, multi-functional features (ex: trading, exchanging).

– **Drawbacks:** Vulnerability to hacks, loss of funds if the provider faces insolvency, lack of control over private keys.

### Non-Custodial Wallets

On the other hand, non-custodial wallets allow users to manage their private keys independently. These wallets can be further categorized into software wallets (desktop or mobile) and hardware wallets (physical devices that store keys offline).

**Software Wallets:**

Software wallets are applications that run on computers or mobile devices. They provide user-friendly interfaces for managing Bitcoin transactions but are still susceptible to malware attacks and phishing attempts.

**Hardware Wallets:**

Hardware wallets, such as Ledger or Trezor, provide a higher level of security by storing private keys offline. This makes them immune to online hacking attempts, although they require careful handling to prevent physical theft or loss.

**Benefits and Drawbacks:**

– **Benefits:** Greater control over funds, enhanced security with hardware wallets, lower risk of hacks.

– **Drawbacks:** Complexity for beginners, the risk of losing access if the wallet is misplaced or damaged.

## The Role of Security Features

Trusting a Bitcoin wallet heavily relies on understanding its security features. The mechanisms employed to protect private keys define how secure a wallet truly is. Some essential security features to consider include:

### Two-Factor Authentication (2FA)

Two-factor authentication adds an extra layer of security by requiring two forms of verification before accessing the wallet. This feature significantly mitigates the risk of unauthorized access.

### Multi-Signature Wallets

Multi-signature wallets require multiple private keys to authorize a transaction. This not only enhances security but also adds a layer of trust when handling funds in partnerships or larger organizations.

### Encryption

Encryption serves as a foundational security measure. Well-designed wallets encrypt private keys and sensitive information, making it difficult for potential attackers to access the funds.

### Backup and Recovery Options

Solid wallets provide users with comprehensive backup and recovery options, often through seed phrases. Users must store these seeds securely, as losing them can result in irretrievable access to funds.

## The Importance of Key Management

Key management is the most critical aspect of maintaining trust in a cryptocurrency wallet. Users must understand that their private keys are the gateway to their assets—losing or exposing them can lead to irrevocable loss of funds.

### Understanding Private and Public Keys

In the Bitcoin ecosystem, every wallet consists of a pair of keys: a public key (similar to an account number) and a private key (akin to a password). While the public key is shareable and used for transactions, the private key must remain confidential. Users should only ever share their public keys to receive funds.

### The Role of Seed Phrases

Most notable Bitcoin wallets utilize seed phrases, a sequence of words used to recover your wallet. Users must ensure they back these phrases up securely, as losing them means losing access to the wallet entirely.

### Best Practices in Key Management

To maintain trust in wallet security, users should adhere to best practices:

– Utilize hardware wallets for long-term storage.

– Regularly back up wallets and seed phrases in secure locations.

– Minimize online exposure of wallets and avoid sharing sensitive information.

## Trust Issues and Challenges

Despite the advancements in wallet technology and security features, users often face trust issues. The cryptocurrency space is riddled with scams, hacks, and fraudulent activities, leading to justified skepticism regarding wallet safety.

### Exchange Hacks and Custodial Risks

Numerous high-profile exchange hacks, such as Mt. Gox and Bitfinex, have resulted in substantial losses for users. These incidents reinforce the potential pitfalls of custodial wallets, as users may lose their funds through no fault of their own.

### Scams and Phishing Attacks

The decentralized and pseudonymous nature of Bitcoin creates a fertile ground for scams. Users may fall victim to phishing attacks that attempt to trick them into disclosing personal information or private keys.

### Regulatory and Compliance Risks

As governments and regulatory bodies grapple with the implications of cryptocurrencies, increased regulation may impact the operational capacity of wallet providers. Users must remain vigilant and understand the legal landscape surrounding their holdings.

## Psychological Aspect of Trust

Trust in Bitcoin wallets is not merely a technical concern; it is also deeply rooted in psychology. Users’ perceptions often influence their choices, emphasizing the role of community sentiment, past experiences, and education levels in building trust.

### The Role of Reputation and Reviews

Before selecting a wallet, users typically seek out reviews, ratings, and experiences from others. A strong community presence, transparent practices, and certifications from reputable security firms can boost a wallet’s credibility.

### Education and Awareness

Better-edited education around cryptocurrency and wallets can empower users to make informed decisions. Many scams stem from a lack of understanding, underscoring the need for comprehensive educational resources.

### Community Trust and Social Proof

Community-driven platforms, forums, and social media channels often serve as resources for garnering trust. Users are likely to favor wallets endorsed by individuals or groups they trust, demonstrating the importance of social proof.

## Future Trends in Crypto Wallets and Trust

As the cryptocurrency space evolves, so too does the technology and sophistication of wallets. Understanding potential future trends can help users navigate the landscape with greater confidence.

### Decentralized Wallets

The rise of decentralized finance (DeFi) is pushing the development of decentralized wallets that enable direct control over funds without third-party intervention. These wallets reduce reliance on custodians, thereby enhancing user trust.

### Enhanced Security Technologies

Emerging technologies, such as biometric authentication, will likely influence wallet security features. As technological advancements unfold, users can expect improved security, making wallets more resilient against attacks.

### Regulatory Advancements

Steady progress in regulatory frameworks may facilitate better protection for users, fostering trust in both wallet providers and the larger cryptocurrency ecosystem. Established regulations can serve to mitigate risks and solidify user confidence.

### Integration with Traditional Finance

The integration of cryptocurrency wallets with traditional financial systems will accelerate their mainstream acceptance. As wallets begin to bridge the gap between digital and traditional economies, users may find greater functionality, security, and usability.

## Conclusion: Building Trust in Bitcoin and Crypto Wallets

In conclusion, trust serves as the bedrock of interactions within the cryptocurrency ecosystem. Choosing a Bitcoin wallet requires careful consideration of various factors, including wallet type, security features, key management practices, and physiological influences affecting user perceptions.

As the cryptocurrency landscape continues to mature, users must remain vigilant and informed. Embracing the knowledge shared in this article can empower users to make wise decisions about how they store and manage their digital assets, ultimately fostering confidence in their chosen Bitcoin and crypto wallets.